Experts Corner: Gartner Releases Magic Quadrant for Cloud Core Financial Applications

Analyst firm finds ERP Market undergoing a generational technology shift – estimates $31B in ERP spending moving to the cloud

Gartner, an independent research firm, recently published its first-ever Magic Quadrant that evaluates cloud core financial management applications. In the report, the analyst firm notes “The market for core financial management suites has been static for many years. However, over the last 12 to 18 months, cloud core financial management suites have matured to an extent that they have disrupted this static market.” In other words, the core financial management suites market is transitioning from traditional on-premises deployment to cloud services.

This analysis aligns with Bridgepoint’s experience in the field. Over the last two to three years, we have seen our clients move from being open-minded about considering cloud systems to adopting a “cloud first” approach. Much of this shift has been due to the emergence of fully functional system that can be rapidly deployed in the cloud.

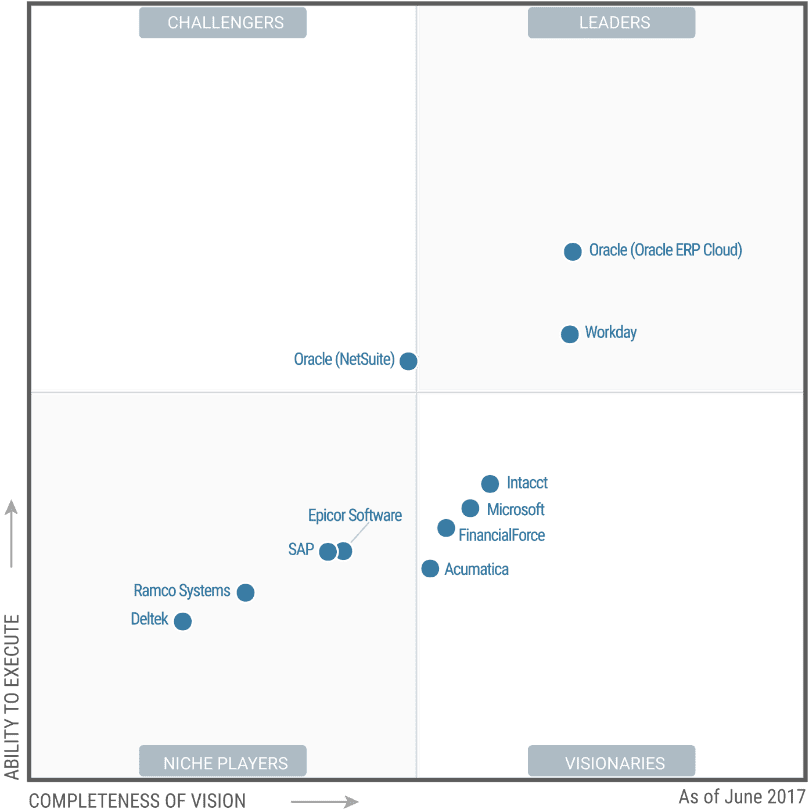

Gartner’s survey showed that “end users value functionality significantly more than technical architecture.” Cloud financial systems are relatively immature compared to existing on-premise systems. This year’s Gartner Magic Quadrant only ranks three systems: Oracle ERP Cloud, NetSuite and Workday as “high” – in terms of ability to execute due to this lack of maturity (see Magic Quadrant graphic below).

Magic Quadrant for Cloud Core Financial Management Suites for Midsize, Large and Global Enterprises. Image credit – MQ via Gartner (click to enlarge)

FOR THIS MAGIC QUADRANT, GARTNER DEFINES CORE FINANCIAL MANAGEMENT SUITES AS FOLLOWS:

- The core functional areas of general ledger (GL), accounts payable (AP), accounts receivable (AR), fixed assets (FA), project accounting, project costing, and project billing.

- Financial analytics and reporting, including provision of financial information (such as P&L and balance sheet) and the ability to provide financial information such as KPIs to managers and executives.

- Basic indirect purchasing functionality (from creating a requisition through to purchase order processing and AP invoice matching and payment), because many organizations — especially midsize organizations — need some basic procurement functionality as part of a core financial applications deployment.

HERE ARE THE THREE KEY THINGS THAT STANDOUT TO ME ABOUT THESE FINDINGS:

- There is no one best solution– Reviewing the pros and cons of the various cloud financial management systems would lead you to different conclusions based on your organization’s specific needs and growth strategy.

- The number of visionaries indicate a changing market – Four visionary providers are noted in the Magic Quadrant: Intacct, Microsoft, FinancialForce and Acumatica. These firms are continuing to bring new solutions to the market, and the landscape may be very different in two years.

- Aligning your organization’s strategy to the provider’s capabilities is critical – A few key considerations to keep in mind: if your organization will be growing rapidly, will the software provider be able to meet those future needs? If they do not have the current capabilities, what are their future product plans?

SO HOW CAN YOUR ORGANIZATION ADDRESS ITS CORE FINANCIAL MANAGEMENT NEEDS GIVEN THE DYNAMIC PROVIDER MARKET?

- Develop a comprehensive set of requirements – Determining the best system for your organization will be highly dependent on your specific needs. Remember to take all factors into consideration as you evaluate technology options so that your software capabilities align with your strategic vision and long-term business growth goals.

- Analyze provider strategies – A few key considerations to keep in mind: Are they just starting their cloud offering or is it a relatively mature product? What is the future direction for the product? How does that strategy align with your organization’s strategy?

- Manage the project using system development best practices – Replacing a financial management system is complex, expensive and risky. It will consume large amounts of internal and external resources. Following the common project management techniques such as developing a project charter, creating detailed requirements and regular executive communication will dramatically increase the chances for a successful outcome.

BRINGING IT ALL TOGETHER

Many of our clients are leveraging cloud-based financial management systems to run their business operations. The solutions are scalable, feature rich and automatically updated regularly. While cloud financial management systems may not be the right solution for everyone, finding the best solution for your organization can allow you to leverage the latest technologies to ensure your ongoing business success.

If you have questions about cloud financial management systems, I’m happy to chat. At Bridgepoint Consulting, we can help your company with any of the activities or approaches mentioned above. Explore our Technology Consulting services or contact us!

Disclaimer: Gartner is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and is used herein with permission. All rights reserved. This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.